Gold Industry Overview

Strong Macro-Economic Trends Have Driven Gold to New Records in 2024–2025

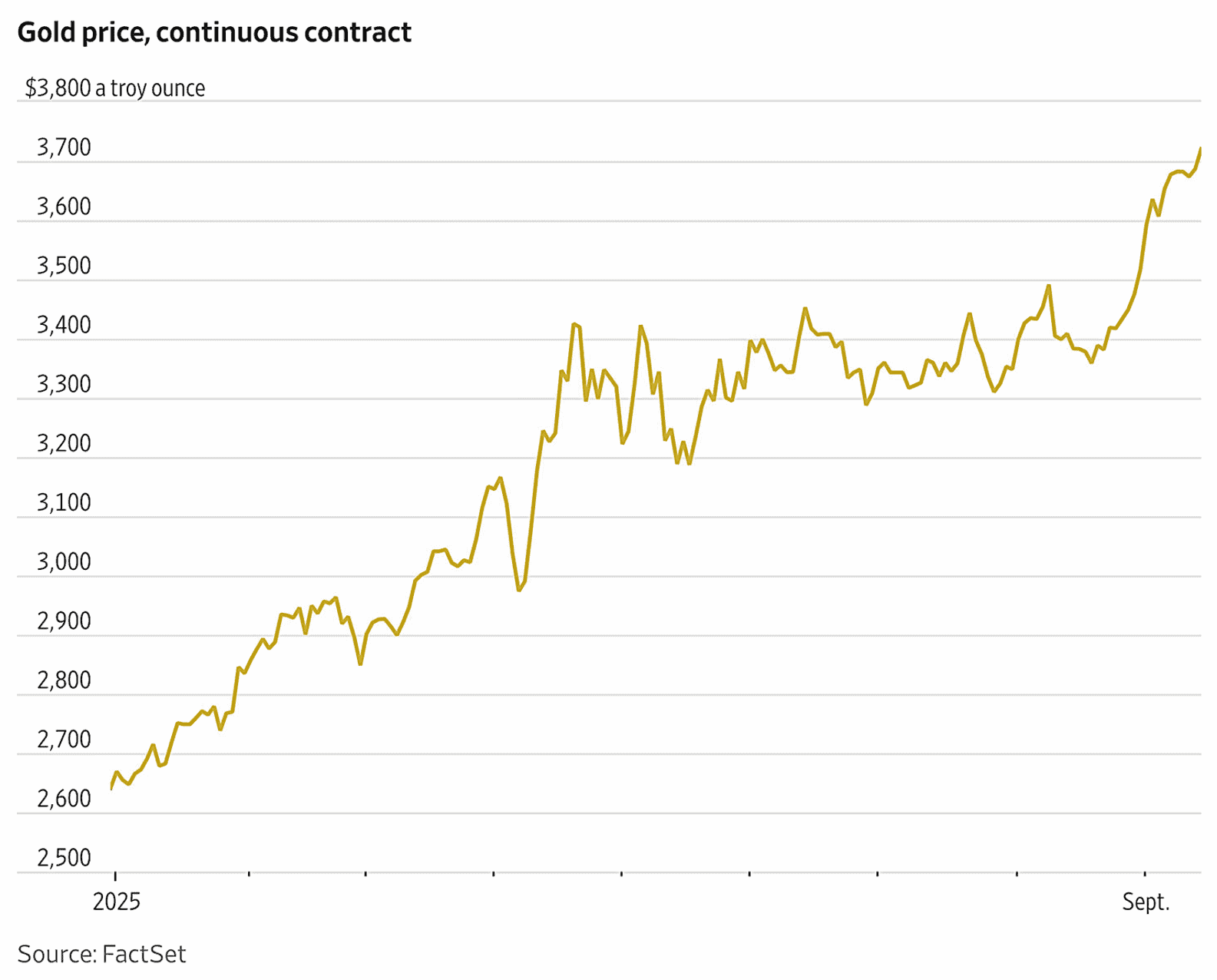

Gold has long served as both a store of value and an industrial commodity. In 2024, gold prices reached 40 new record highs, marking a significant surge in the precious metal’s value.

This upward trajectory continued into 2025, with gold setting 37 consecutive all-time highs, culminating in a peak of $3,788.33 per ounce in September, 2025.

Factors contributing to this remarkable performance include global economic uncertainties, geopolitical tensions, and a weakening U.S. dollar, all of which have driven investors toward gold as a safe-haven asset.

The upward trend is expected to continue. Goldman Sachs now sees gold reaching ~$3,700/oz by end-2025.

J.P. Morgan anticipates average gold of ~$3,675/oz in Q4 2025, with a potential move toward ~$4,000/oz by mid-2026.

UBS forecasts ~$3,600 by March 2026 and ~$3,700 by mid-2026, reflecting continued strong institutional demand.

Central Banks and Economic Uncertainty Fuel Gold’s Momentum

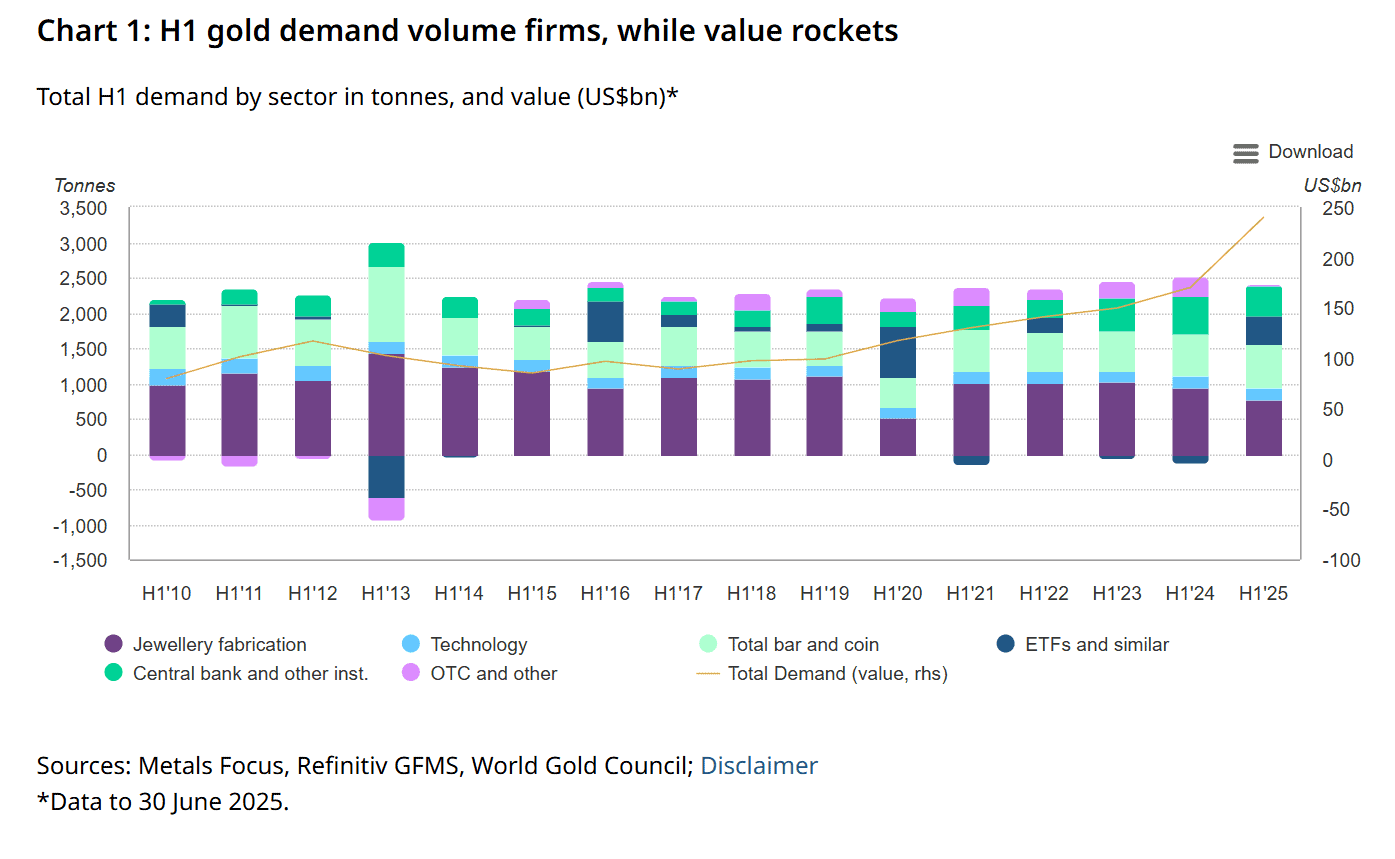

Central banks have played a major role in driving gold demand. Purchasing 483 t in the first half of 2024 and continuing strong buying into early 2025, with 244 t in Q1 alone.

Picture 1: Displays Gold Price Data as for September 2025

This reflects a strategic push to diversify reserves and reduce reliance on fiat currencies amid global economic uncertainty. At the same time, gold demand from the electronics sector surged, rising 14% year-over-year in Q2 2024 (67.6 t), driven by AI and high-performance computing applications.

Key Drivers of Gold Demand (2025)

Gold’s enduring value and modern utility

Investment and Reserve Diversification

Gold remains a trusted hedge against inflation and currency volatility. Central bank purchases have continued, highlighting its role as a stable asset amid ongoing economic uncertainty.

Industrial Use

Growth in advanced technology, electronics, and green energy sectors has sustained industrial demand for gold. Its excellent conductivity, corrosion resistance, and reliability keep it essential for high-tech and emerging applications.

Market Outlook and Future Trends

The structural demand for gold is expected to remain strong throughout 2025 and into 2026.

The interplay of economic uncertainties and technological advancements will likely maintain upward pressure on gold prices. With consistent central bank purchases and innovative applications in emerging technologies, gold remains a vital component of global financial and industrial ecosystems.

Source: https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-q2-2025

Silver Macro Landscape Overview

Silver Hitting a 14-Year High, Driven by Robust Demand from Industrial & Consumer Applications

Silver continues to gain momentum as a critical industrial and investment asset following a strong performance in 2024, when its average annual price rose by more than 21% according to the Silver Institute.

In September 2025, silver surged to approximately $46 per ounce, reaching its highest level in 14 years(1). This rally has been fueled by investor flows into precious metals amid economic uncertainty, geopolitical turmoil, and record-breaking momentum in gold.

The sustained uptrend is underpinned by strong industrial usage, particularly in clean energy technologies, alongside resilient consumer demand and limited production growth. Silver’s essential role in the global energy transition remains a key driver.

Key Drivers of Silver Demand (2025)

As of late September 2025, silver demand is experiencing significant growth, driven by three primary factors

Industrial Applications

Silver’s exceptional electrical and thermal conductivity, malleability, and antibacterial properties make it indispensable across multiple sectors, including:

Electronics (circuitry, semiconductors, batteries)

Automotive Industry (EV components, safety systems)

Defense and Aerospace (specialized alloys, sensors, coatings)

Energy Transition

The global shift toward renewable energy sources is significantly impacting silver demand in.

Photovoltaic (Solar) Cells – the single largest growth sector for silver usage, with solar manufacturing demand setting records in 2024 and projected to expand further in 2025(3).

Electric Vehicles (EVs) – requiring silver for power electronics and charging infrastructure.

Energy Storage Systems – benefiting from silver’s conductive and durable properties.

Consumer and Investment Demand

Silver’s relative affordability compared to gold makes it attractive to both consumers and investors. Despite rising prices, silver remains popular in jewelry and silverware, while financial demand continues through Exchange-Traded Funds (ETFs) and other vehicles according to Yahoo! Finance.

Market Challenges and Opportunities

Rising demand amid economic uncertainty

The silver market is currently shaped by a strong demand outlook, particularly from green technologies like solar power and electric vehicles, which are driving structural supply deficits(4). Supply is constrained due to declining ore grades, regulatory hurdles, and the fact that most silver is mined as a byproduct of other metals(4). Meanwhile, investment and safe-haven demand are increasing as macroeconomic uncertainty and inflation fears persist(1). However, silver faces challenges including:

- Price volatility and sensitivity of industrial demand to economic slowdowns.

- Potential substitution risks in some technology applications.

- Cost pressures on mining operations.

While higher prices could unlock new mining projects and stimulate recycling efforts, ongoing volatility and geopolitical risks continue to create uncertainty in both supply and pricing.

Sources

1. TradingEconomics, Silver Price Historical Data (September 2025). Link

2. DiscoveryAlert, “Silver Driving 14-Year Highs: Supply and Demand 2025” (September 2025). Link

3. AZoMining, “The Role of Silver in the Global Energy Transition” (2025). Link

4. CruxInvestor, “Surging Industrial Demand Tightens Silver Supply, Triggering Strategic Repricing in 2025” (2025). Link